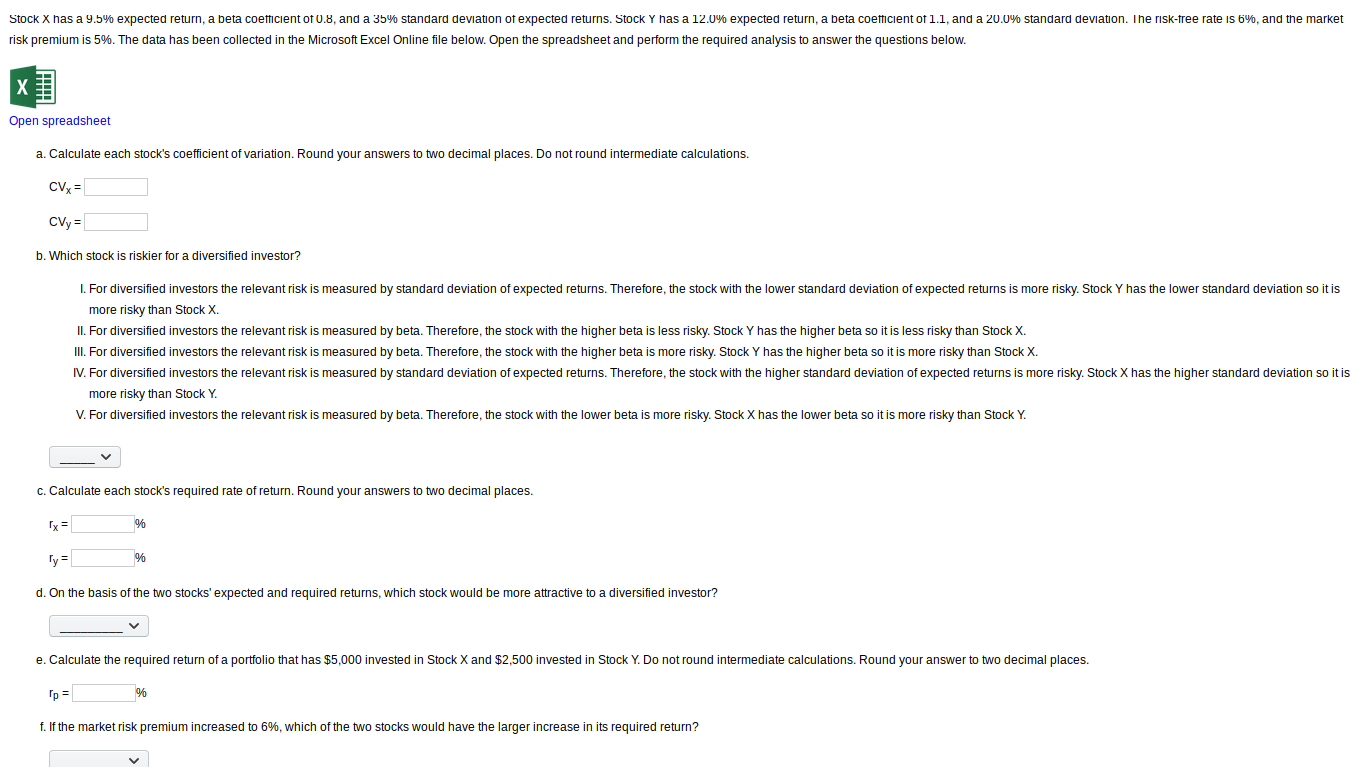

modern portfolio theory - Given two risky stocks calculate the rate of return, standard deviation, beta, and risk-free rate - Quantitative Finance Stack Exchange

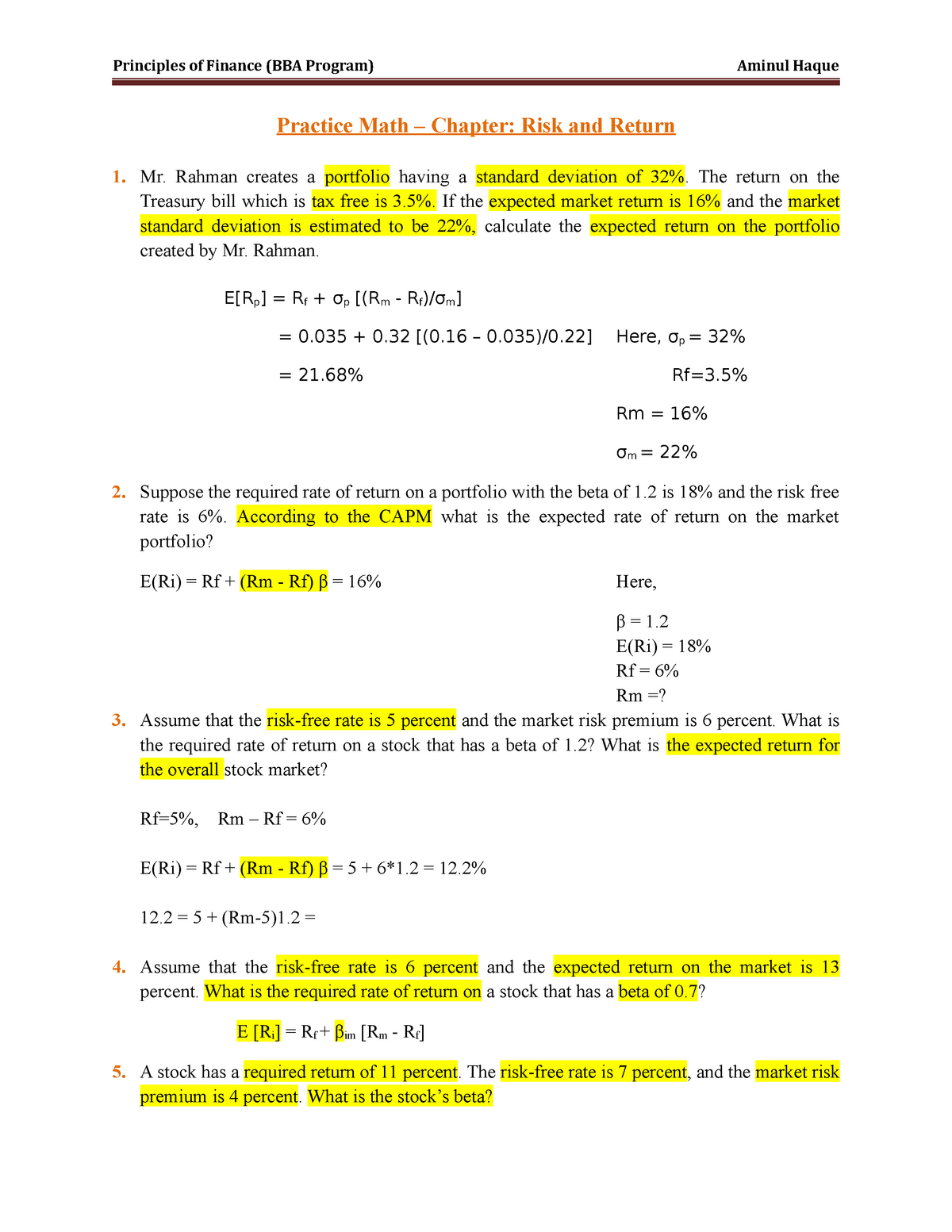

Practice Math - This document is helpful for who take financial management system course as - Studocu

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

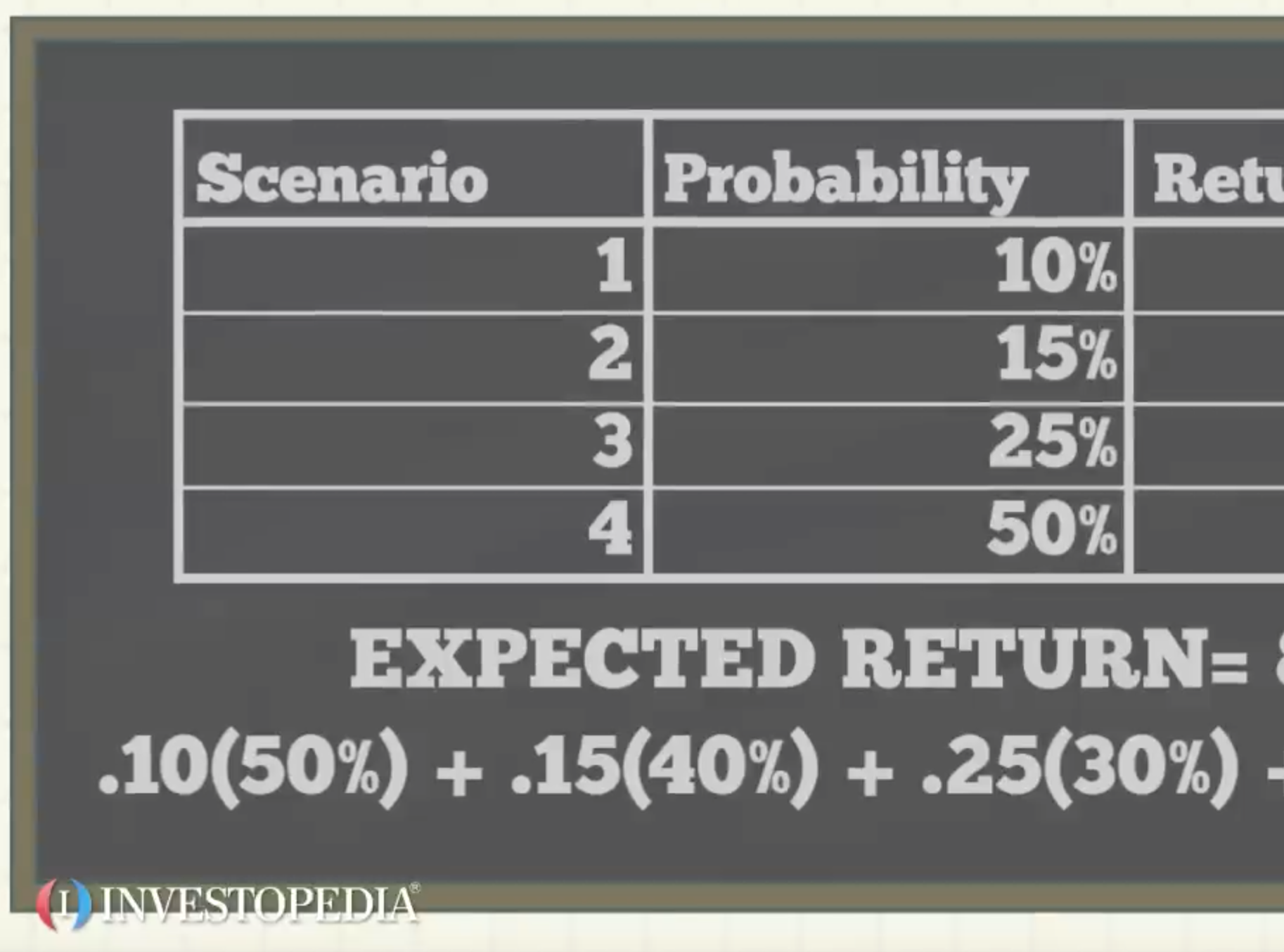

:max_bytes(150000):strip_icc()/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)