From Our Heart to Yours: For Care Givers of Loved Ones with Short Term Memory Loss, the Surprises, Your Feelings and Your Gifts (English Edition) eBook : Duncan, Isabella: Amazon.es: Tienda Kindle

Memory Loss: Improve your Short-term Memory - Memory Improvement Treatment for Rapid Recovery: Signs, Symptoms and Causes and How to prevent Memory Loss ... Treatment - Memory Loss therapy Book 1) eBook :

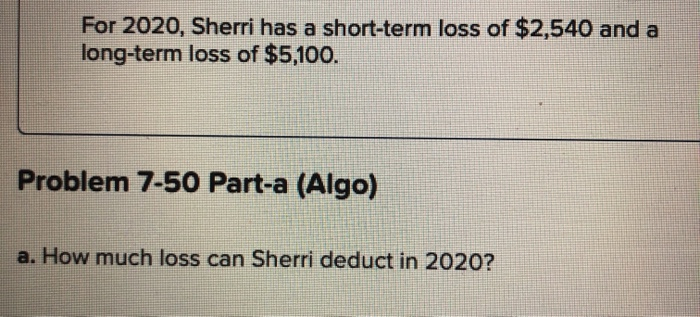

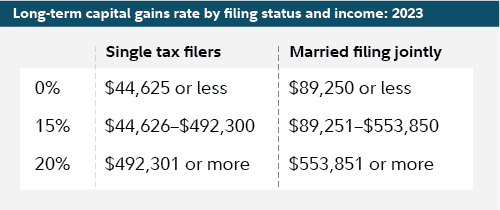

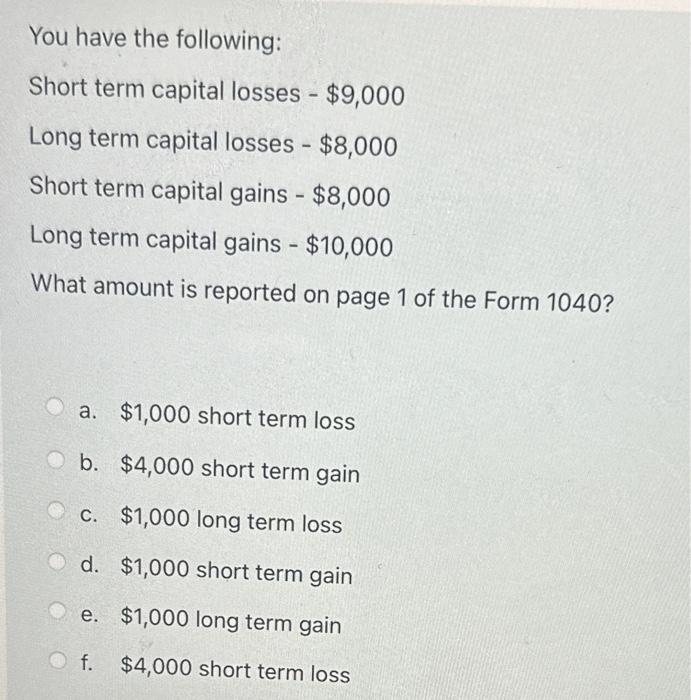

What to do if you suffer loss in business or investment: How to set off losses to cut tax, manage finances - The Economic Times

B/F business loss can be set off against short-term capital gains arising from sale of business assets: ITAT

Distinct factors associated with short-term and long-term weight loss induced by low-fat or low-carbohydrate diet intervention - ScienceDirect

Income Tax Department, India - UNDERSTANDING CARRY FORWARD AND SET OFF OF LOSSES Income comes under five heads - salary, income from house property, income from business and profession, capital gain and

.jpeg)