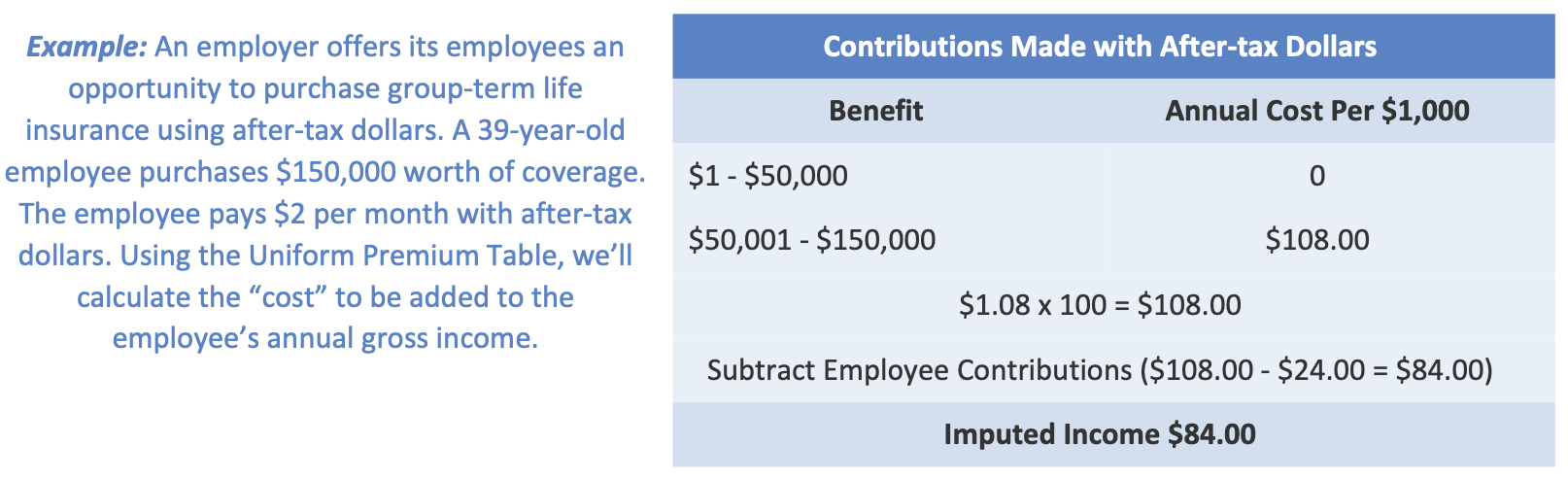

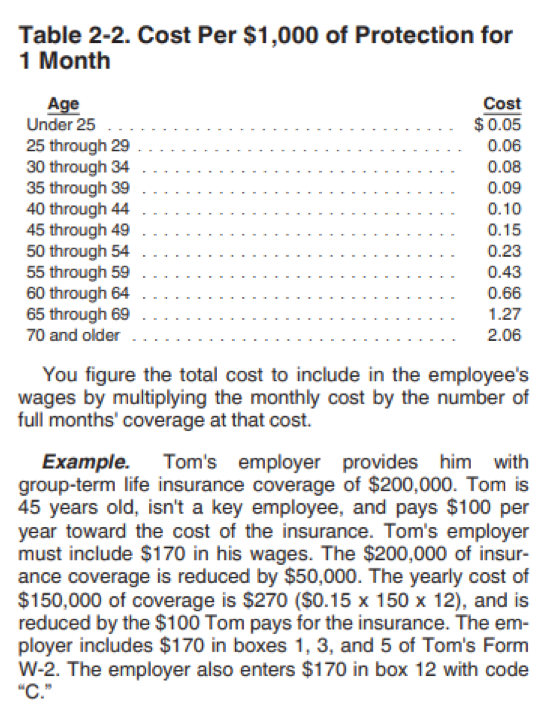

IMPUTED INCOME Employer-provided Group Life insurance will generate additional taxable income to you if you are covered for more

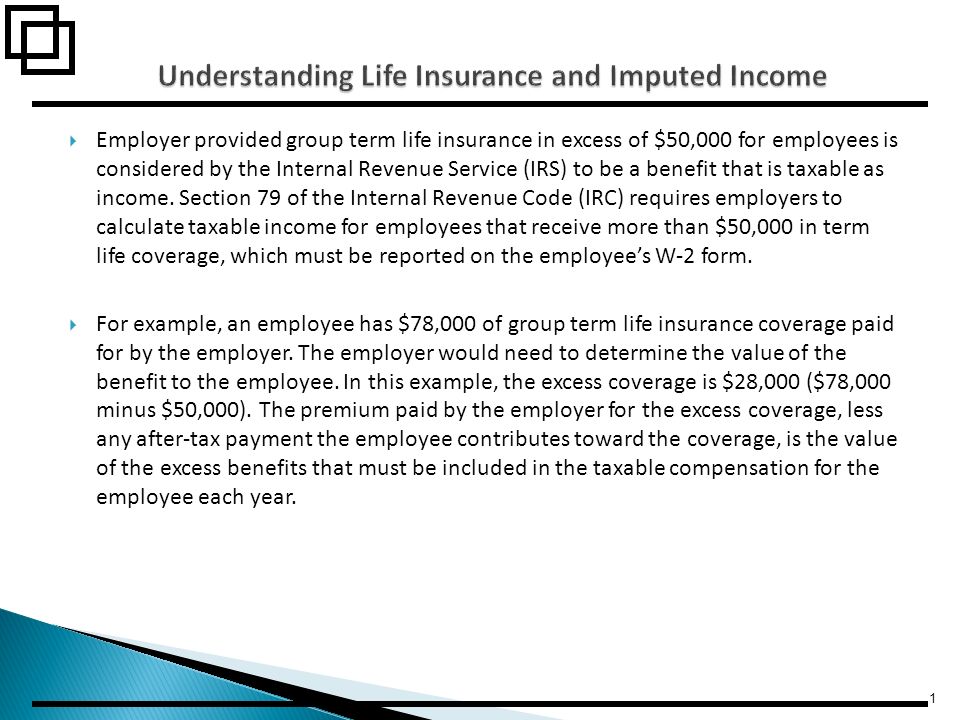

Employer provided group term life insurance in excess of $50,000 for employees is considered by the Internal Revenue Service (IRS) to be a benefit that. - ppt download

GROUP LIFE INSURANCE – IMPUTED INCOME CALCULATION Employers can generally exclude the cost of up to $50,000 of group-term life

![What Is Group Term Life Insurance? [Top 3 Advantages & Disadvantages] What Is Group Term Life Insurance? [Top 3 Advantages & Disadvantages]](https://www.lifeinsuranceblog.net/wp-content/uploads/2020/06/Group-Term-Life-Insurance.jpg)

:max_bytes(150000):strip_icc()/do-beneficiaries-pay-taxes-life-insurance.asp-final-7e81561536514dbdb30500ba1918afb3.png)

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)