Trading zero-coupon bond with maturity T = 5 years. Average unimpacted... | Download Scientific Diagram

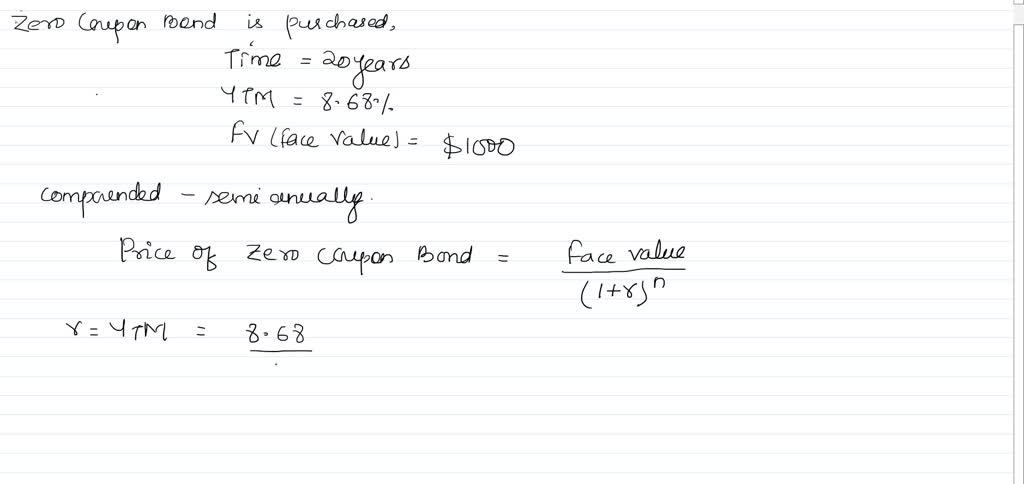

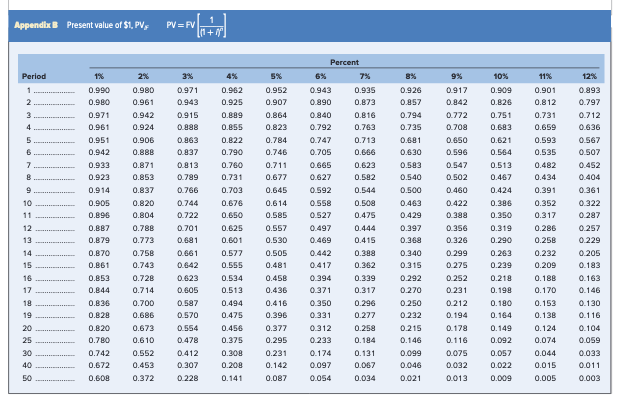

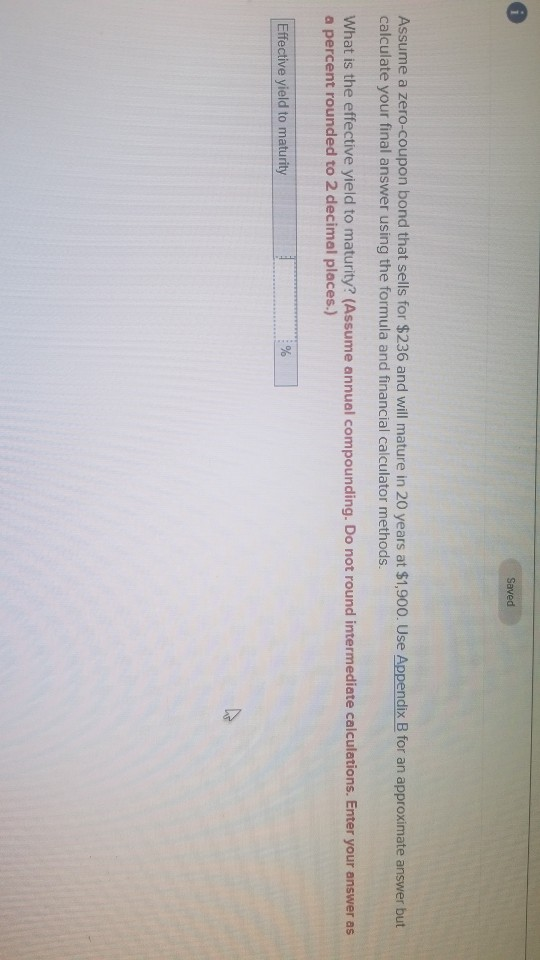

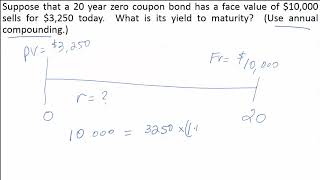

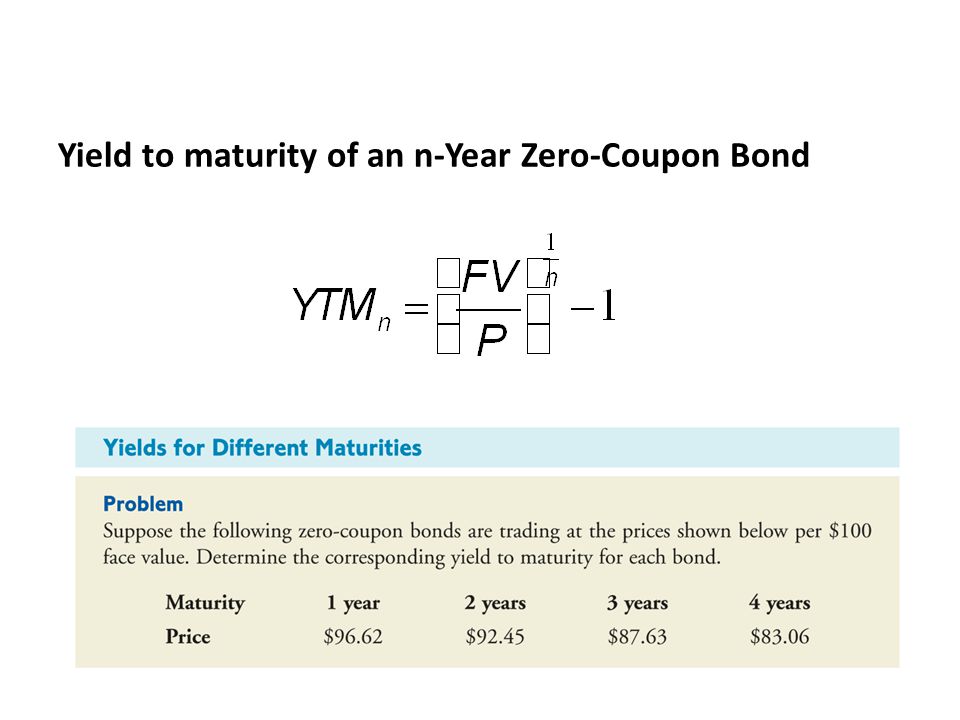

What is the yield to maturity (YTM) of a zero coupon bond with a face value of $1,000, current price of $820 and maturity of 4.0 years? Recall that the compounding interval